You never want to hear volatility and finances in the same sentence. But, you will. You’ll hear it often. Especially if we’re talking about digital currencies. Volatility is present in all spheres of finances and investment. Some assets are more volatile, others less. Some markets are not volatile others are a little bit. When it comes to cryptocurrencies volatility is off the charts. That’s why people love them. That’s why old-fashioned investors hate them. There’s no in-between. But, before you form an opinion, you need to learn a few things about financial volatility.

Whatever you think of it, it’s here to stay. The world of digital currencies can’t be imagined without it. It is what makes it so interesting. People who are invested in digital currencies already learned to swim on the waves of BTC volatility. Other crypto do not differ too much. You can’t say that there is a stable crypto. Not in today’s market. When we see the monumental events that happened in recent years, such as COVID-19, or the ongoing conflict in Europe, we can tell that the whole world is volatile. Why should crypto be any different? It shouldn’t. It is the way it is. All you need to do is to better understand its volatility.

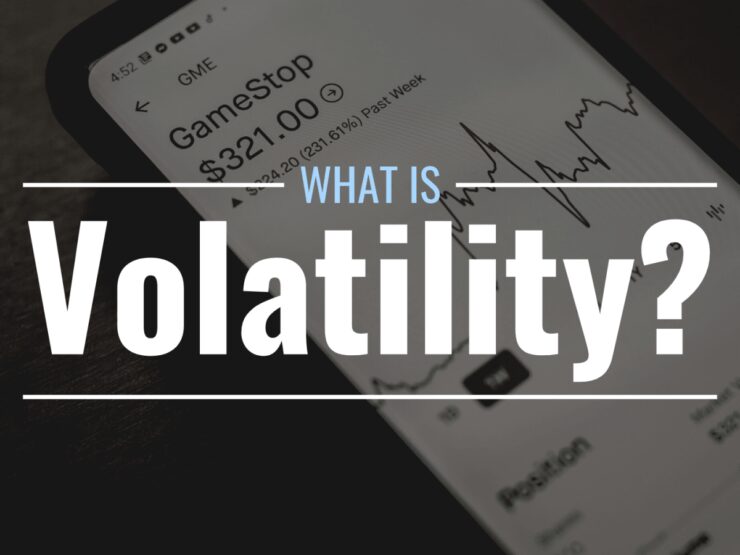

What is Volatility?

Let’s start with this question. In hindsight, it is quite simple. You’ll learn the best about it through investing. But that road can be painful. So, let’s first talk about it in theory. Everyone who ever entered the trading and investing world quickly encountered volatility. It is always present when it comes to buying and selling assets. Here, we are talking about a measure, a statistical one. It’s what you expect your returns to be when you deal with stocks, indexes, or in this case crypto. It is closely tied to the risks of doing business. The higher the volatility the more risks are involved. This term is tied to market swings. This is the best way to describe it. When a market is frequently dropping or rising over short periods it is seen as volatile. If you’re even remotely familiar with crypto markets you know that they are seen as the most volatile out there.

So, considering that volatility is tied to risks, why do people trend toward it? The answer is simple. A volatile market offers better chances of earning more. Yes, at the same time, it offers you equal chances of losing your assets quickly too. The more volatility you have on your plate the more risks your investment holds. Many old-school investors compare operating in volatile markets to gambling. But, modern ones see it as an opportunity and find ways of facing volatility head on, and some examples of how to do it, you can find at blockchainreporter.net, and embrace volatility with more ease. Now that you know the basics of volatility it’s a good time to see how it ties to digital currencies.

Cryptocurrencies and Volatility

Digital currencies have been around for a while now, but their market is still rapidly growing. This is already old news. It’s volatile too. Quite a few millionaires came to crypto, but some people lost it all too. Crypto has two sides to a coin. You can meet them both. Maybe you gained a lot on Bitcoin and lost as much on some other digital currency. It happens. We all saw the rise and fall of Luna. In the end, it doesn’t matter if you bet on crypto or against it, what matters more is to have the right timing when it comes to both rises and falls. Despite its volatility, digital currency is a great investment. Bitcoin is the greatest one especially. But, we are going to tell you the truth. They are hard to predict. Very hard. Almost impossible. If you’ve been following this market closely you’ve noticed this. There is no trend when it comes to crypto.

As you know, all digital currencies are decentralized. There are no millions of dollars of gold bars covering their value. For some, they are thin air. This might be the truth. No one is backing any crypto. The creator of the initial digital currency, Bitcoin, remains a mystery to this day. It’s things like this that make it volatile. Some people believe that there will come s day when crypto will be stable. We are not of that opinion. The only way for it to be stable is to drop in value. Its current worth is based on the action surrounding it. It increases its value when people trade for it, and exchange other assets, money, and different crypto for it. This is what gives it value. The way the market shifts towards it and backs from it increases or lowers its value. That is how close volatility is tied to crypto. You can’t say an investment-themed sentence tied to digital currencies without mentioning volatility.

You need to embrace it. When it comes to the market of digital currencies, volatility swims in waters of its own. What deters most new investors is the fact that you can’t measure the crypto volatility. All that you can spot is that it had some of the biggest spikes and that it hit some of the rock bottoms. The volatility of crypto is an extreme one. The worst part is that you can’t pull future conclusions based on past events. It’s not possible.

Conclusion

So, while the two remain tightly close, it’s hard to predict the future. That’s what makes crypto so fun. A great investment if you are willing to take risks. Yes, various crypto came and vented, but that’s the same situation many other markets are experiencing. If you want to focus on the negative, that’s fine. But what about Bitcoin? This digital currency is at the top of the pyramid of investments and we’re not talking only about digital currencies. It created such a rift in the world of investments that it still hasn’t healed. It won’t for a while. It will only keep growing, right up until…

Related Posts:

- 20 Best Gaming Headset Under 50$ 2024 - for PC, PS4,…

- Top 10 Best Scrubs For Women 2024 - Pants for Nurses…

- Top 10 Best Inflatable Kayak 2024 - for Exploring…

- Top 10 Best Dog Nail Grinder 2024 - Best Care for Your Pet

- 10 Best External Hard Drive 2024 - Compatible With…

- Top 10 Best Paint Sprayer For Cabinets 2024 -…