Crypto traders use different trading strategies that work for them. Pattern day has become one of the most profitable and easy methods for crypto traders. Are you interested in pattern crypto trading and want to understand its rules? Then, we have outlined the essential information for you.

Introduction To Pattern Day Trading And Its Rules

The US Securities and Exchange Commission and the Financial Industry Regulatory Authority introduced the pattern day trading rule. The rule is intended to safeguard users from the dangers of bargained retail trading accounts. If trading on margin, the day traders should show that they have enough budget to trim losses.

A pattern day trader is defined as someone who shuts four-day transactions or more in the duration of five days with a total value of above 6% of their deposit. In the case where the account holder has reached this limit, the broker will issue a margin call, requiring them to add more money.

According to the specified criteria, the trader must close the trades at this time. Users can begin to trade again if they fulfill the margin warning. A pattern day trader’s platform must have $25,000 at the least in the form of equity. The pattern day trading guideline applies to all security assets. It comprises choices like market shares, penny stocks, CFDs, bonds, ETFs, and crypto coins like Bitcoin.

In case of pattern day trading violation, there is no penalty apart from the margin account freezing until you add more money. Cash accounts are not covered by the law. The penalty can differ because the broker is the one who will impose the limitation. It is not permanent and will be removed at some point. In general, it usually stays about 90 days. However, if the broker has vague restrictions, the time frame will shorten.

Since the ban is intended to safeguard retail traders, it does not relate to establishment stock brokers. Being a pattern day trader is not illegal, but individuals who rely on this method must demonstrate that they have sufficient money to bear the risks. When filing your taxes, you might discover that you are authorized for Trader Tax Status if you are a pattern day trader with sufficient funds. You can check out www.advfn.com to know the various benefits of making crypto transactions.

Navigating Pattern Day Trading Rules

The pattern day trading ordinance was formulated to save commercial investors from potential risks. Look at the below tips to ensure you are trading legitimately.

- Enough capital

It is allowed to engage in pattern day trading, but you must have sufficient funds in your account to verify that you can afford to incur the danger. You no longer have to bother about the regulation if you have $25,000 to trade. Make sure to top up money to maintain your account. However, if you want to start investing with $1000 click this and make sure to add more funds to meet the minimum requirement and maintain your account’s balance.

- Grip positions overnight

Only day trades are subject to the PDT regulation. As a result, if you carry a position overnight, it will not count as one of your four transactions.

- Premarket hours Vs. after hours

A trade that is made after business hours, even during the exact day, is not considered a day trade. On the other hand, it counts as a day trade if you make a trade before the market opens and shuts it the same day.

- Utilize a cash account

Only margin accounts are eligible for pattern day trading. You can completely circumvent the rule if you trade with a cash account instead of a margin one.

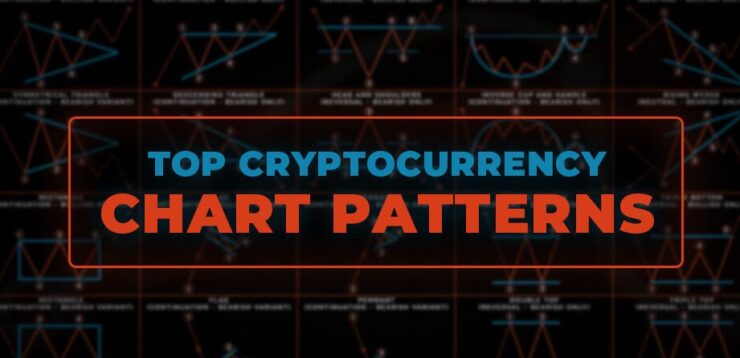

What Are Crypto Chart Patterns

Price patterns that occur on a chart are known as chart patterns. Skilled traders depend on the succession of patterns to measure market sentiment. In order to take trading decisions, these charts are supplemented with other types of technical calculations like candlestick graphs or technical pointers.

You can find plenty of different chart patterns while trading cryptocurrency. Due to their subjective nature, there is no solid proof that one structure is better than the other. However, here we have mentioned a few chart patterns that several traders found beneficial.

Price Channels Charts

Price channels are formed by attaching a continuation of highs and lows with two descending, ascending, or horizontal parallel lines. Prices will jump between these levels of friction (higher) and support (lower). Breakouts or breakdowns can be critical swings for several traders, especially those who purchase at the lowest and sell at the prime.

Rising Triangle And Falling Triangle Cryptocurrency Charts

One horizontal trend line attaches highs or lows, while a sloped trend line shows highs or lows to form soaring and plummeting triangles. The price is likely to surge or decrease from the straight line in the direction of the sloped chain at the decision point formed by the right triangle.

Head And Shoulders Crypto Charts

The Head and Shoulders chart pattern is illustrated by a transient peak or low, followed by an even larger high or low, and then a third movement that is equivalent to the initial move. The chart looks like a right-up (bearish) or upside-down head with two shoulders (bullish).

Triple, Double Top, And Bottom Charts

A triple or double top and bottom chart pattern occur when markets jump off with the same resistance or support levels for about two or three times in succession.

A double bottom is a bullish indication, whereas a double top is a bearish indication. The triple and double patterns are turnaround settings, signaling that prices are about to shift. Despite the fact that double tops and bottoms are far more common in crypto graph patterns, triple patterns usually yield more reversals.

Soaring Wedge And Decreasing Wedge Graph Charts

Soaring and plunging wedges are identical to climbing and falling triangles with the exception that the upper and down lines are both slanted in the exact direction. Rising and falling wedges are reversal patterns. A bearish clue is a rising wedge, whereas a bullish signal is a decreasing wedge.

Bottom Line

We have mentioned the necessary details you should know about the pattern day crypto trading. While investing in any crypto, make sure to strategize your trading plan and invest accordingly.

Related Posts:

- 20 Best Gaming Headset Under 50$ 2024 - for PC, PS4,…

- 15 Best Shoes for Walking on Concrete 2024 - Soft &…

- 12 Best Car Wax For Black Cars 2024 - Protection and…

- Top 10 Best Paint Sprayer For Cabinets 2024 -…

- Top 16 Best Office Chair Covers 2024 - Chair…

- Top 10 Best Outdoor Basketball Shoes 2024 - Durable…